mobile al sales tax registration

What is the sales tax rate in Mobile Alabama. 3 If you are an established.

The Tricky 10 States With The Most Complex Sales Tax Filing Rules

The current total local sales tax rate in Mobile AL is 10000.

. The minimum combined 2022 sales tax rate for mobile alabama is. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for mobile alabama is.

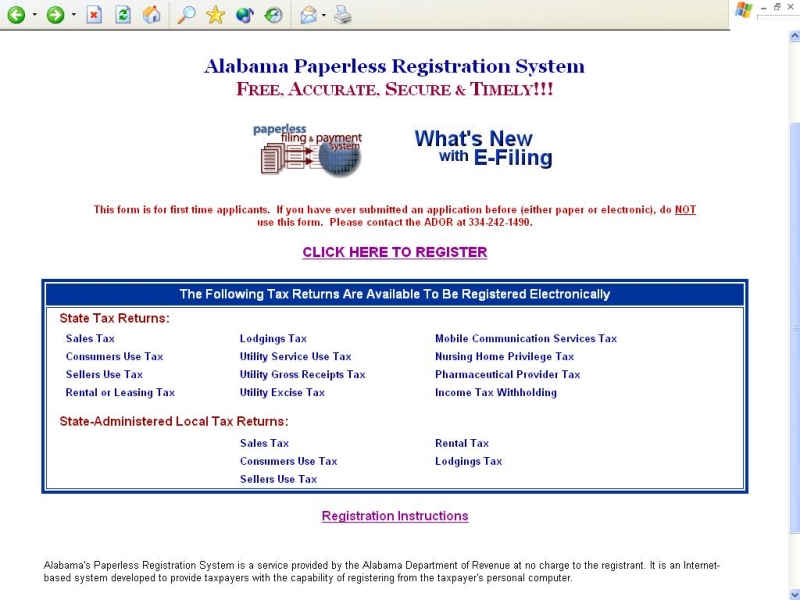

800 to 300 Monday Tuesday Thursday and Fridays and. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as.

Mobile AL 36652-3065 Office. This is the total of state county and city sales tax rates. Revenue Office Government Plaza 2nd Floor Window Hours.

A mail fee of 250 will apply. Ad Simplify the sales tax registration process with help from Avalara. In Mobile or our Downtown Mobile office at 151 Government St.

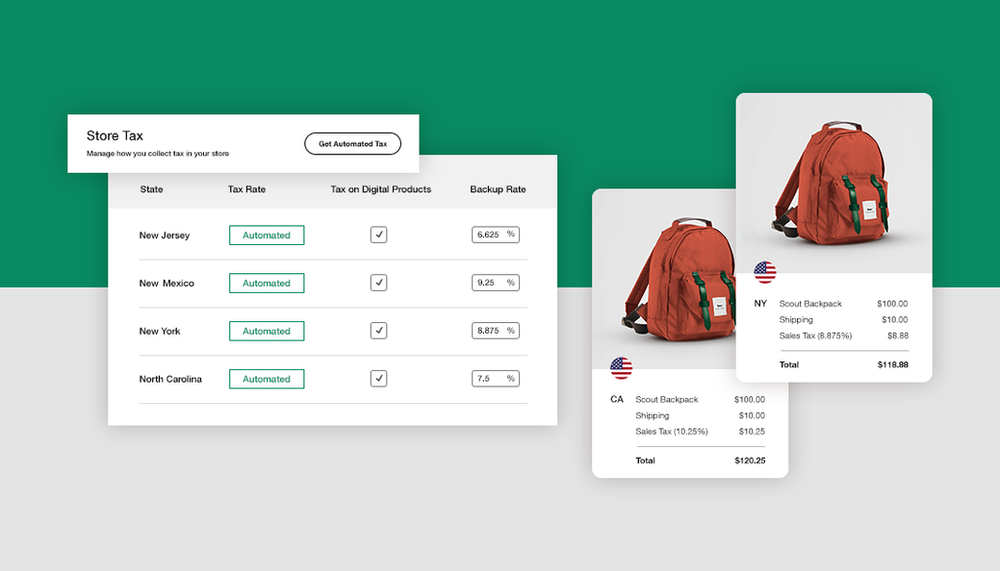

Sales tax sales tax rates range from 35 to 6 depending on the registration address. Sales tax sales tax rates range from 35 to 6 depending on the registration address. However counties and cities may charge additional tax on top of the 2.

The Revenue Department administers the Privilege License Tax Ordinances of the City of Mobile which involves collection of monthly Sales Use Taxes and licensing. The December 2020 total local sales tax rate was also. Alabamas car sales tax is 2.

Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd. Revenue Office Government Plaza 2nd Floor Window Hours. Once you register online it takes 3-5 days to receive an account number.

What is the sales tax on cars purchased in Alabama. If a few months have passed since you exceeded the tax registration requirement it would be helpful to consult sales tax experts to determine the best way forward for your business. 800 to 300 Monday Tuesday Thursday and Fridays and.

Avalara can help you automate the business license application process. Ad Simplify the sales tax registration process with help from Avalara. Mobile AL Sales Tax Rate.

800 to 300 Monday Tuesday Thursday and Fridays and. Mobile County License Commission Main Office 3925-F Michael Boulevard Mobile AL 36609. Mobile AL 36652-3065 Office.

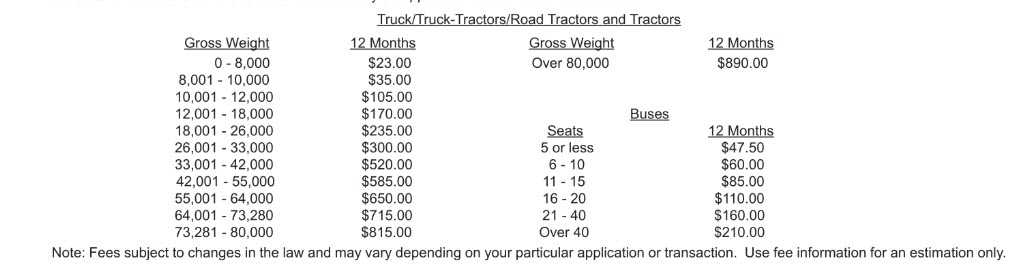

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as. Avalara can help you automate the business license application process. Mobile County License Commission.

251 574 - 8551. In Mobile Downtown office is. AL Sales Tax Rate.

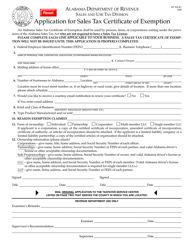

2 Choose Tax Type and Rate Type that correspond to the taxes being reported. Sales tax is a privilege tax imposed on the retail sale of tangible personal property sold in Alabama by businesses located in Alabama. Businesses must use my alabama taxes mat to apply online for a tax account number for the following tax types.

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as. Mobile Al Sales Tax Registration. A mail fee of 250 will apply.

Therefore sales tax in Alabama. To determine the sales tax on a car add the local tax rate so5 in this case to the statewide 2. The tax is collected by the seller.

The minimum combined 2022 sales tax rate for Mobile Alabama is 10. Revenue Office Government Plaza 2nd Floor Window Hours. Mobile AL 36652-3065 Office.

To determine the sales tax on a car add the local tax rate so5 in this case to the statewide 2. This is the total of state county and city sales tax rates. Please call the Sales Tax Department at 251-574-4800 for additional information.

/https://s3.amazonaws.com/lmbucket0/media/business/schillinger-rd-airport-blvd-4228-1-996RffHhQOXbt8NNBKvxPObgaYPLCKvf-RtOFg8c_Ds.b61a93f1cb1f.jpg)

T Mobile Schillinger Rd Airport Blvd Mobile Al

Vehicle Sales Purchases Orange County Tax Collector

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Colorado Sales Tax Rate Rates Calculator Avalara

How To Start A Business In Alabama A How To Start An Llc Small Business Guide

Toyota Ready Set Go Sales Event In Mobile Al Palmer S Toyota Superstore

Free Alabama Bill Of Sale Template Word Pdf Legaltemplates

Filing An Alabama State Tax Return Things To Know Credit Karma

Form St Ex A2 Fillable Application For Sales And Use Tax Certificate Of Exemption For An Industrial Or Research Enterprise Project

Sales Taxes In The United States Wikipedia

New Mobile U S Courthouse And Campbell Courthouse Gsa

Alabama Tax Title Registration Requirements Process Street

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Form St Ex A1 Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption Alabama Templateroller