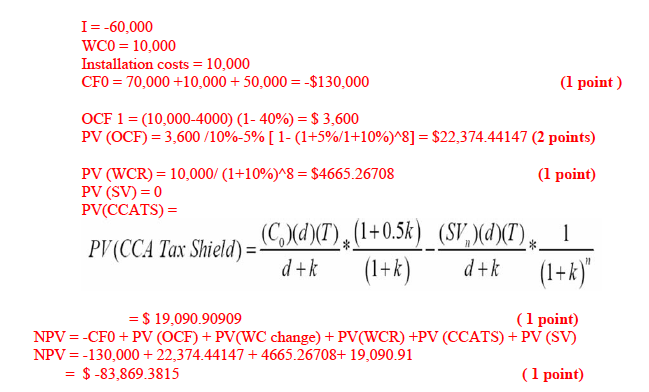

tax shield formula cca

The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. INCOME APPORTIONMENT FORMULAS.

Q 4 6 Points Tax Shield Inc Is Considering A New Chegg Com

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

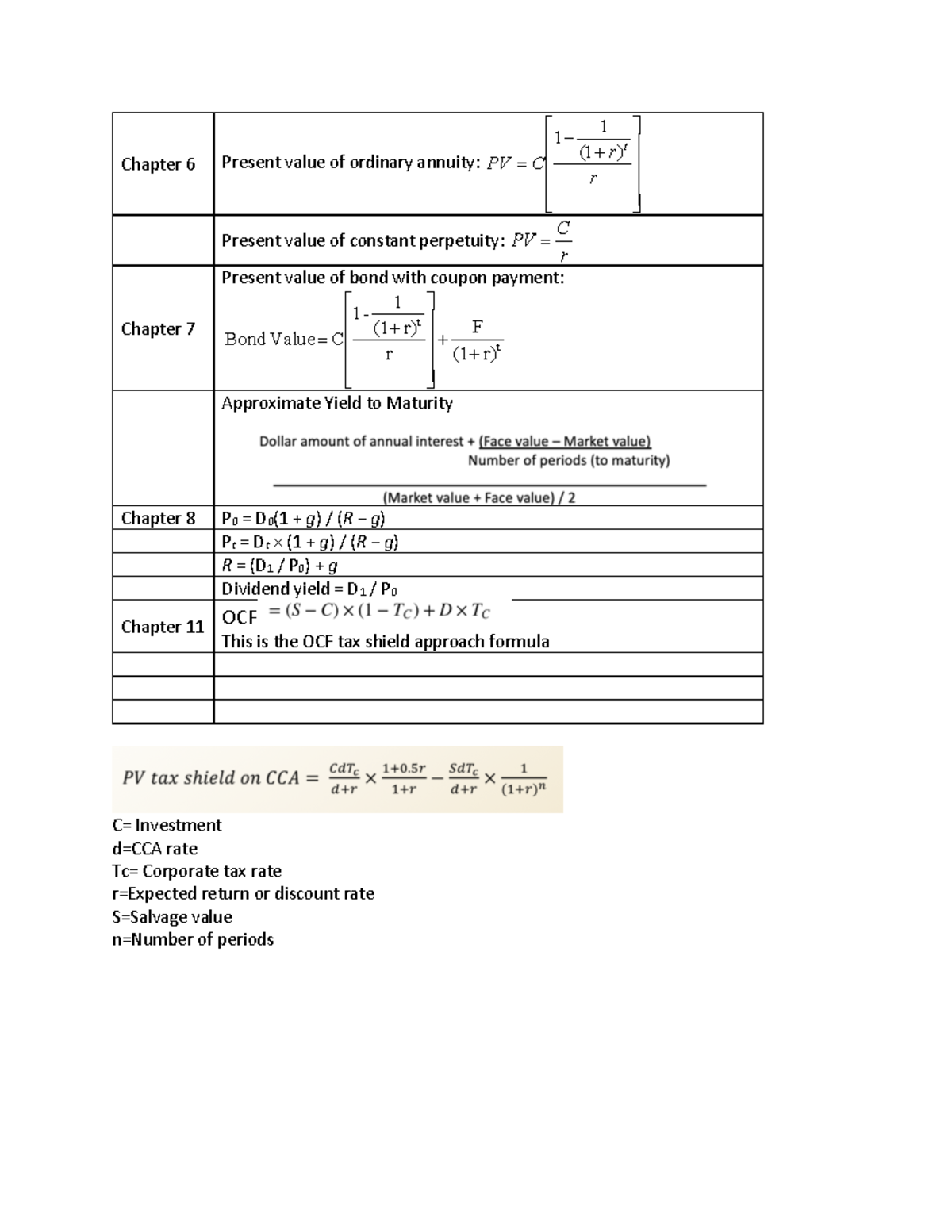

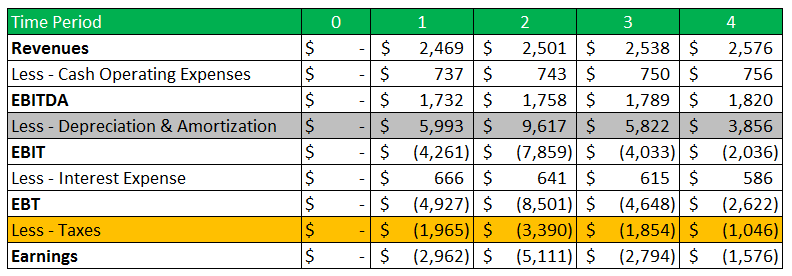

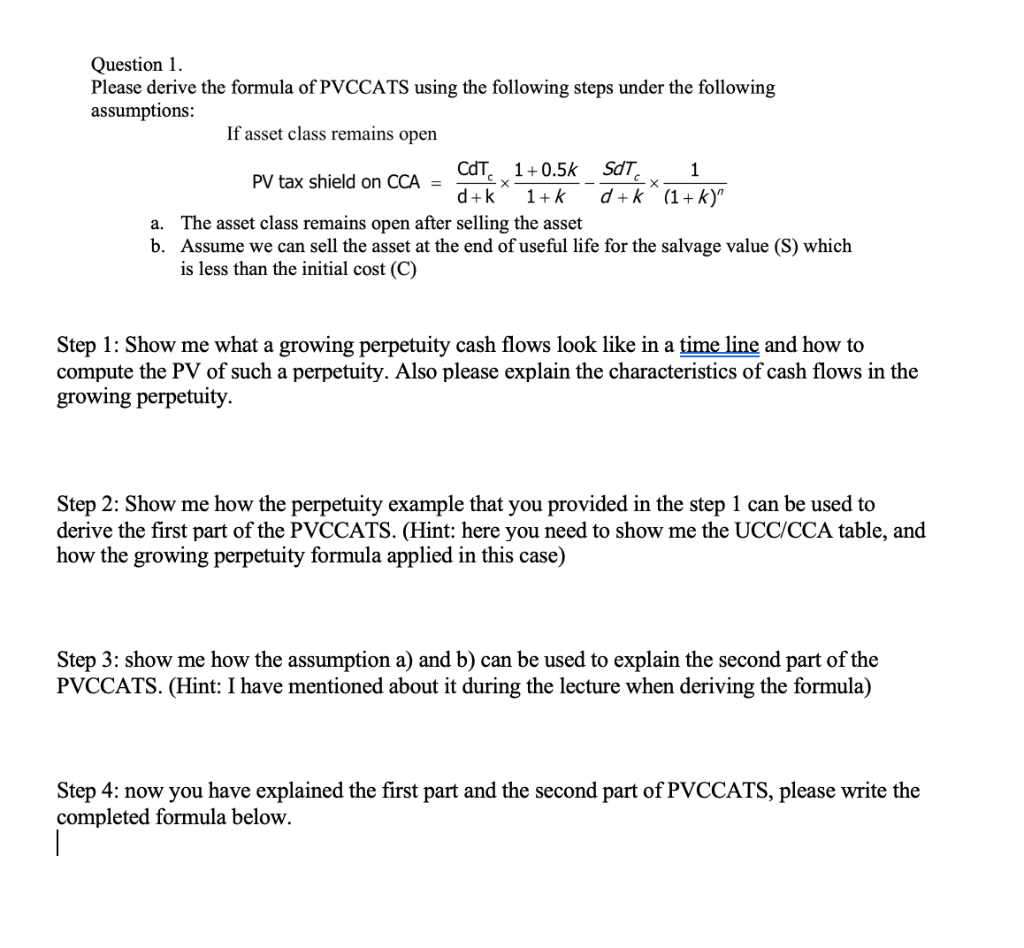

. 50000000 020 035. This is equivalent to the 800000. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation.

This companys tax savings is equivalent to the interest payment multiplied by the tax rate. As such the shield is 8000000 x 10 x 35 280000. Cca Tax Shield Formula 1d47pexe9m42.

This is equivalent to the 800000. P V C C A T a x S h i e l d C 0 d T d k 1 05 k 1 k S V n d T d k 1 1 k n. Uniform Final Exomination Report TABLE - 1997 125 III A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX.

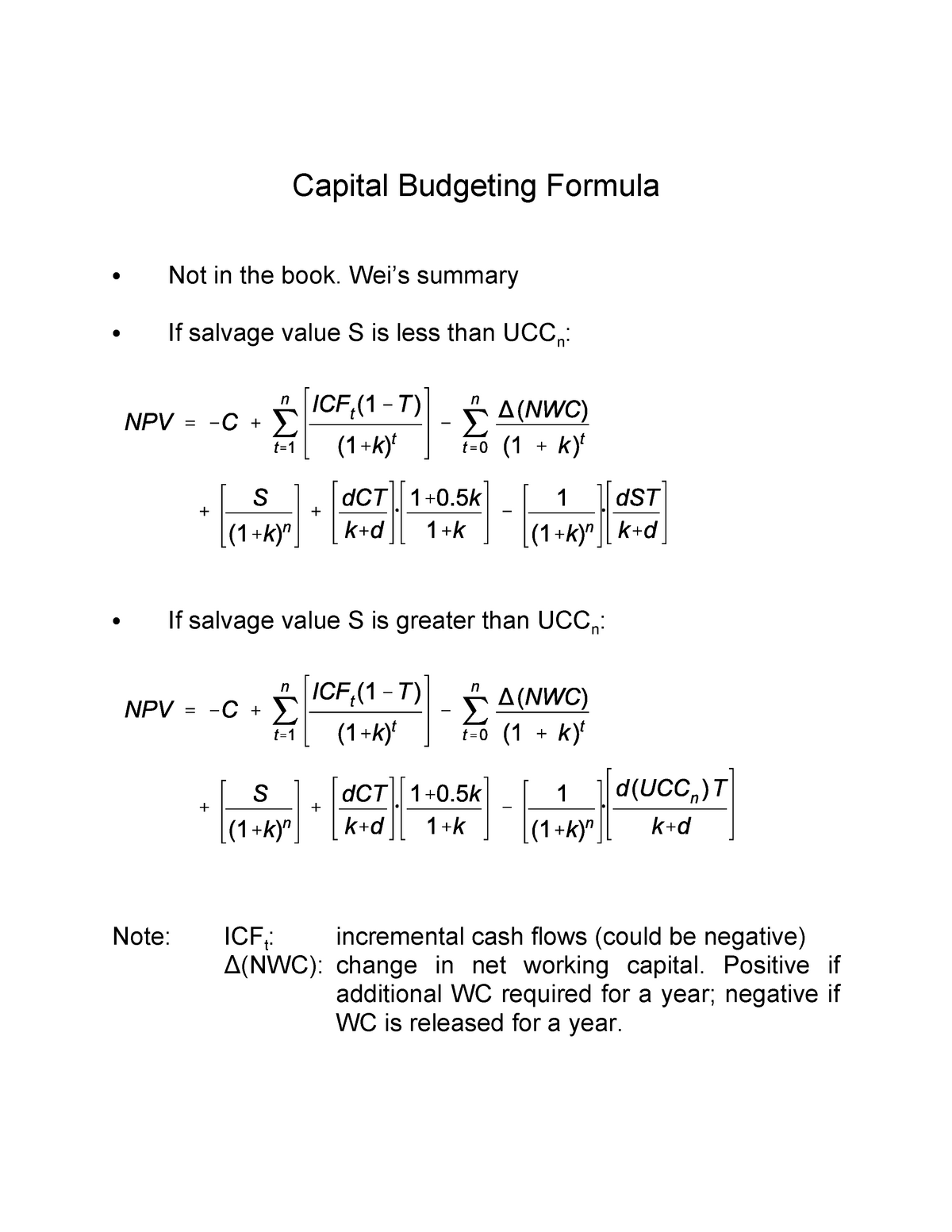

The wrong discount rate 11 rather than the hurdle rate of 15 was used in the tax shield formula. C If salvage value S is greater than UCC n. Answer b is correct.

This is equivalent to the 800000. As such the shield is 8000000 x 10 x 35 280000. Salvage Value versus UCC Using the methods described in the pro-forma statements will give incorrect answers when the salvage value differs from its UCC If the asset is depreciated.

This companys tax savings is equivalent to the interest payment multiplied by the tax rate. 2 Third Street Suite 250 Troy New York 12180. That is why we dont have that line.

Weis summary C If salvage value S is less than UCC n. The net incremental cash flow is 1350000 75686 present. Thus if the tax rate is 21 and the business has Last Update.

Capital Budgeting Formula C Not in the book. As such the shield is 8000000 x 10 x 35 280000. All states with corporation taxes use at least one of the following corporation tax income apportionment formulas.

This companys tax savings is equivalent to the interest payment multiplied by the tax rate. Your CCA tax shield is worth 9110316. FOR PROFIT CONSTRUCTION CCA-2 1 of 8 INSTRUCTIONS FOR COMPLETING THE NEW YORK STATE VENDOR RESPONSIBILITY QUESTIONNAIRE FOR PROFIT.

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

Fi Chapter 1 Capital Budgeting Flashcards Quizlet

Solved A Firm Is Thinking About Launching A New Brand Of Bicycle The Course Hero

Cca Capital Budgeting Capital Budgeting Formula C Not In The Book Wei S Summary C If Salvage Studocu

Formula Jpg Pv Of Cca Tax Shield Formula Pv Tax Shield On Cca Cch X 0 S X 1 D K L K D K 1 17c L Where C Cost Of Asset D

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

Formula Page 1 Warning Tt Undefined Function 32 C Investment D Cca Rate Tc Corporate Tax Rate Studocu

Tax Shield Formula Step By Step Calculation With Examples

Solved Your Firm Is Considering Investing In A Supercomputer To Implement A New Revolutionary Web Service The Pre Tax Cash Flow Excluding Cca Tax Course Hero

Pdf Npv Steps Formula S Given 1 Tax Shield New The Coorsx Academia Edu

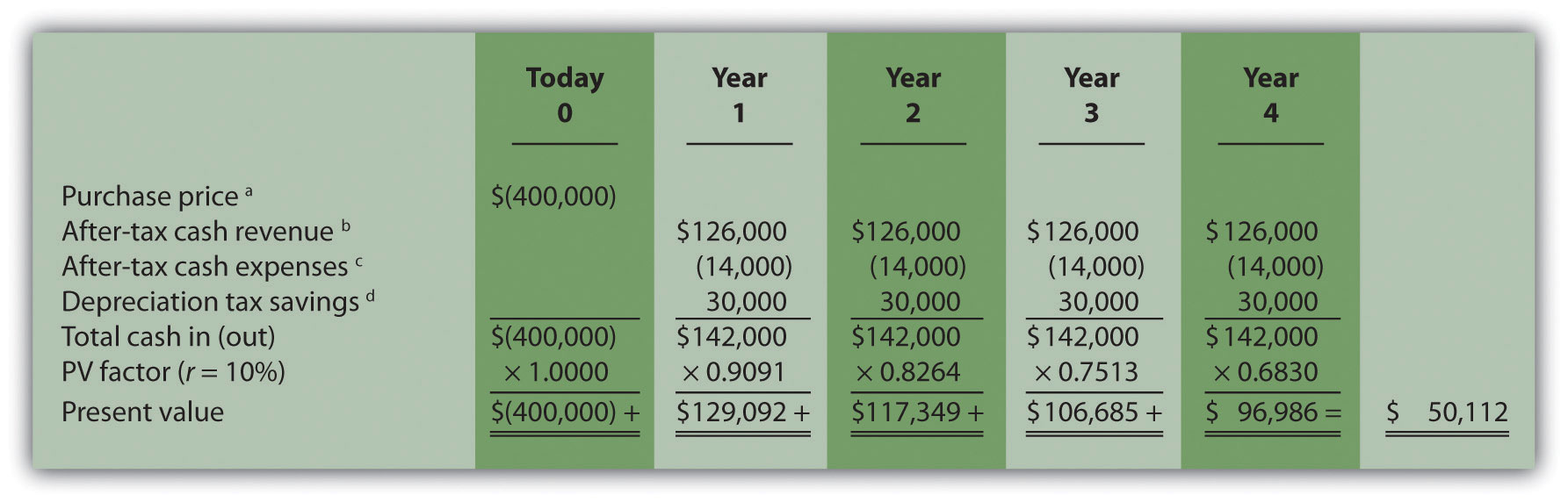

The Effect Of Income Taxes On Capital Budgeting Decisions

How To Npv Tax Shield Salvage Value Youtube

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Formula Jpg Pv Of Cca Tax Shield Formula Pv Tax Shield On Cca Cch X 0 S X 1 D K L K D K 1 17c L Where C Cost Of Asset D

Introduction To Corporate Finance Laurence Booth W Sean Cleary Ppt Download

Formula Jpg Pv Of Cca Tax Shield Formula Pv Tax Shield On Cca Cch X 0 S X 1 D K L K D K 1 17c L Where C Cost Of Asset D

Depreciation Tax Shield Formula Examples How To Calculate

Solved Question 1 Please Derive The Formula Of Pvccats Chegg Com